Will a December Rate Cut Finally Ignite the Metro Atlanta Housing Market? A Homebuyer's Guide

Hey there, Atlanta homebuyers! I'm Paul McParland, and I've been helping families find their dream homes in Metro Atlanta for years. Right now, I'm hearing the same questions from nearly everyone I talk to: "Paul, should we wait for rates to drop?" and "What's happening with the Fed in December?"

The anticipation is real. Many of you have been waiting patiently on the sidelines through years of high prices and elevated mortgage costs, watching the Federal Reserve's every move. With whispers of a possible interest rate cut at the Fed's December meeting, there's a wave of cautious optimism building.

But here's what I want to help you understand: what does a Federal Reserve rate cut truly mean for you as someone looking to buy a home in our bustling, competitive Atlanta market? The relationship between the Fed's actions and your mortgage rate is more complex than most people realize, and the impact on competition and affordability is something we need to talk through together.

In this guide, I'm going to break down everything you need to know about the December rate cut possibilities, explain how Fed policy actually affects your monthly mortgage payment, and share my insights on what this means specifically for homebuyers across Metro Atlanta.

The Rate Cut Outlook: Why December Matters

The Federal Reserve's Federal Open Market Committee meets regularly to set the federal funds rate—a key economic benchmark. While the Fed doesn't directly control mortgage rates, its decisions ripple through the entire financial market, affecting Treasury bond yields that are closely linked to long-term mortgage rates.

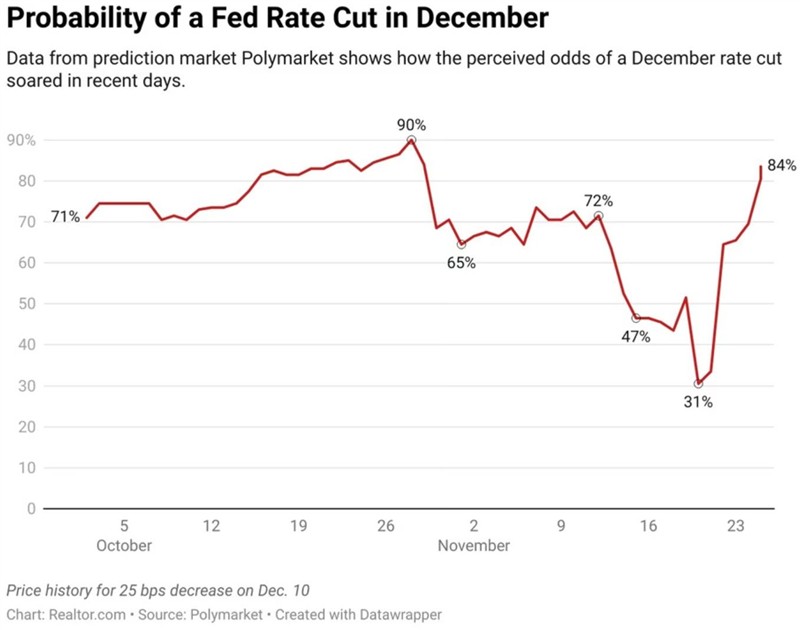

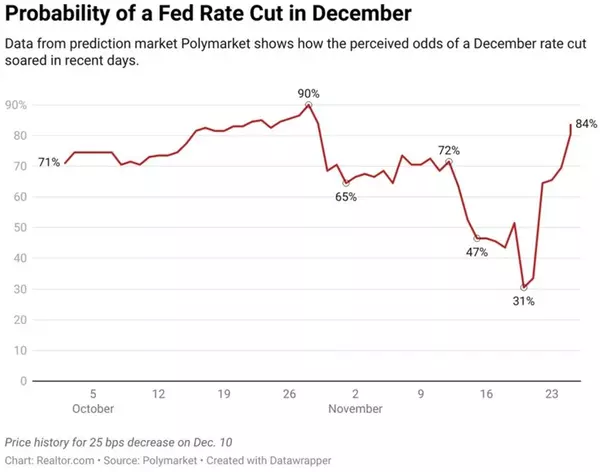

Recent economic data has created a compelling case for the Fed to shift from fighting inflation toward policies that stimulate growth. Prediction markets have recently shown an elevated probability, sometimes over 80%, of a 25 basis point rate cut at the December 9-10 meeting. That said, these odds can swing dramatically based on incoming job reports and inflation data. Some economists remain cautious, suggesting the Fed may want more concrete evidence before making a move.

Understanding the Connection: Fed Rate vs. Your Mortgage Rate

This is where I see a lot of confusion, so let me clear it up. A Fed rate cut doesn't automatically mean your 30-year fixed mortgage rate drops by the same amount. Here's why:

The Federal Funds Rate: This is what banks charge each other for overnight lending. It mainly affects short-term products like credit cards and adjustable-rate mortgages.

30-Year Fixed Mortgage Rate: This is tied more closely to the 10-year Treasury yield. Investors in mortgage-backed securities base their returns on long-term economic and inflation outlooks, which the 10-year Treasury reflects.

When the Fed cuts rates, it's signaling that inflation risks are easing and the economy needs support. This can push down the 10-year Treasury yield, and with it, mortgage rates. But the connection isn't always immediate or predictable. I've seen periods where Fed cuts were followed by mortgage rates actually rising as investors demanded higher returns to offset future inflation concerns.

What This Means for You as a Metro Atlanta Homebuyer

For those of you house-hunting in Metro Atlanta, any decrease in mortgage rates is significant news. Right now, the average 30-year fixed mortgage rate in Georgia is hovering between 6.00% and 6.30% (as of early December 2025). Even a modest drop of 0.25% to 0.50% could substantially improve your purchasing power and completely change the market dynamics.

1. The Affordability Boost

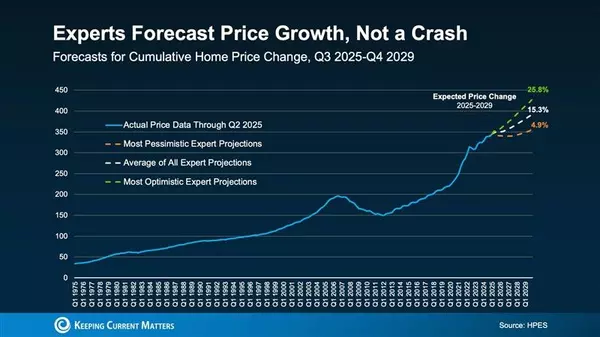

Metro Atlanta has been dealing with serious affordability challenges, with home prices remaining well above pre-pandemic levels. A drop in mortgage rates directly impacts your monthly payment, and that's what really determines affordability.

Increased Budget: Lower rates mean you can afford a higher-priced home without increasing your monthly housing expense.

Opening Doors for First-Time Buyers: The National Association of Realtors suggests that sustained rates in the 6% range could make homeownership accessible for millions more households nationwide. Atlanta is predicted to see one of the biggest increases in sales activity. This is especially huge for first-time buyers who've been most sensitive to payment increases.

2. The Competition Factor (This Is Important!)

Here's the trade-off: better affordability almost certainly means more competition. Lower rates act like a magnet, drawing in two major groups of buyers who've been waiting:

The "Rate-Locked" Sellers: I've had countless conversations with homeowners who have 3%–4% mortgage rates and feel trapped. They want to move but can't stomach financing their next home at a much higher rate. As new rates fall, this psychological barrier lessens, and we'll finally see some of these homeowners list their properties. More inventory would be a welcome relief!

The Pent-Up Demand Wave: There are thousands of buyers who've been priced out or chose to wait because rates climbed above 6.5%. The moment rates drop, they're coming back and fast.

This surge in demand could quickly eat up any new inventory and lead to bidding wars and upward pressure on prices. Here in Atlanta, where we've consistently had tight inventory. Months of supply recently came in around 4.6, still indicating a seller's market, this rush of buyers is something we need to prepare for. The increased competition is exactly why having a proactive strategy is so crucial.

My Strategic Advice for Metro Atlanta Homebuyers

Given the potential volatility a rate cut could create, you need a clear game plan to take advantage of the opportunity without getting caught up in a competitive frenzy. Here's what I'm telling my clients:

1. Get Pre-Approved Right Now

Don't wait for the official rate cut announcement. Get fully pre-approved with a local Atlanta lender who understands our market. Your pre-approval letter will strengthen your offer tremendously, especially in multiple-offer situations. Work with your lender to run payment scenarios at various interest rates so you can pivot quickly when rates move.

2. Be Ready to Move Fast

If rates dip, the best-priced and most desirable homes will see immediate, intense competition. Atlanta already has relatively fast sales cycles, this could mean you need to make an offer the day a property hits the market. Have your down payment funds accessible and know your absolute maximum offer price before you start looking.

3. Explore Creative Financing Options

In this rate environment, innovative financing can make a real difference:

Rate Buydowns: Some builders and sellers are offering temporary or permanent buydowns, where they pay funds upfront to lower your interest rate for the first few years or the entire loan term. This can bridge the gap until future rate cuts make refinancing attractive.

Adjustable-Rate Mortgages (ARMs): If you're planning to sell or refinance within 5 to 7 years, an ARM might offer a lower initial rate than a 30-year fixed mortgage. It's a calculated move that rates will continue falling, allowing you to refinance before the adjustable period kicks in.

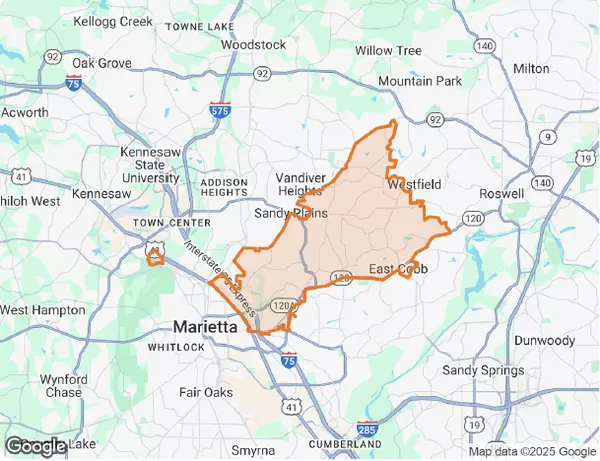

4. Consider Expanding Your Search Area

While intown Atlanta neighborhoods are always desirable, rates in the 6% range still challenge affordability in the core counties. I encourage my clients to explore the outer Metro Atlanta suburbs and exurbs, areas like Hall, Cherokee, Douglas and parts of Gwinnett and Coweta where median prices are more reasonable. Combining lower home prices with lower rates gives you the most dramatic improvement in monthly affordability.

The Bottom Line: A Critical Moment for Our Market

The prospect of a December Federal Reserve rate cut has brought us to a critical juncture in the Metro Atlanta housing market. While the connection between the Fed's actions and 30-year mortgage rates isn't perfectly direct, the sentiment of easing monetary policy is already helping pull mortgage rates down, offering real improvements in affordability.

For those of you ready to buy in our region, this isn't a time to sit back and wait, it's a time for strategic preparation. Lower rates will bring both opportunity (more affordable monthly payments) and challenges (significantly more competition). By getting your finances organized, understanding how rates really work, and having a clear plan, you can navigate this market shift and finally secure your place in the thriving Atlanta community.

If you have questions about your specific situation or want to discuss how these changes might affect your homebuying timeline, I'm always here to help. That's what I do, guide you through the complexity so you can make confident decisions.

Let's find your Atlanta home together.

Paul McParland

Your Trusted Metro Atlanta Realtor

PaulMcParland.com

Categories

Recent Posts

"Whether buying or selling a home, my #1 job is to advise my clients so they optimize their largest financial investment while avoiding any pitfalls that could cost them tens of thousands of dollars. "