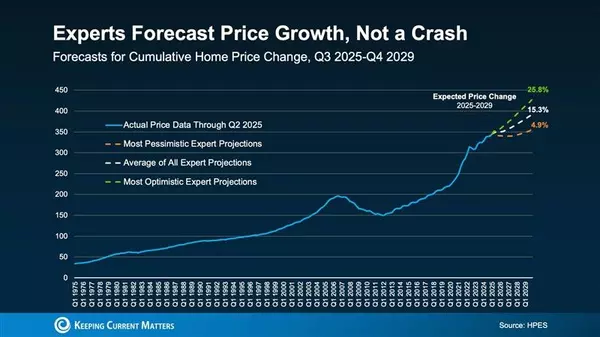

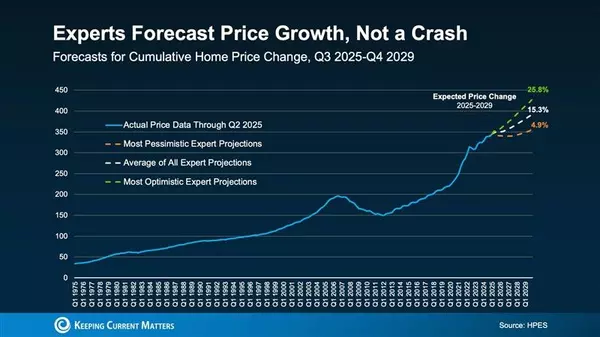

Experts Forecast Steady Home Price Growth in Atlanta Through 2029

In the ever-evolving landscape of the U.S. housing market, recent projections from leading experts paint a picture of sustained, albeit moderated, growth. According to Fannie Mae's Home Price Expectations Survey (HPES), which polls over 100 housing economists and market strategists, national hom

Mid-October Magic: Why This Week is Prime Time to Snag an Atlanta Home Deal

Mid-October Magic: Why This Week is Prime Time to Snag an Atlanta Home Deal As the leaves turn in Metro Atlanta and the air crisps up, savvy home hunters know there's a subtle shift in the real estate winds. It's October 6, 2025, and if you're eyeing a new pad in Buckhead, a cozy starter in Deca

Buy a Home in Atlanta Now: Capitalize on Market Oversupply

Atlanta's vibrant culture, booming job market, and diverse neighborhoods have always drawn homebuyers. In 2025, an unprecedented oversupply of homes creates a buyer-friendly market, with more choices, lower prices, and greater negotiating power. Here's why now is the time to buy in Atlanta and how

Categories

Recent Posts