Financing Ideas for First-Time Homebuyers in Atlanta

By Paul McParland, Your Friendly Atlanta Realtor

Buying your first home is an exciting milestone—but figuring out how to pay for it? That can feel a little overwhelming. If you’re a first-time homebuyer here in Metro Atlanta (or thinking about becoming one), I’ve put together some helpful financing options and tips that can make the journey a lot smoother—and more affordable.

1. 🏡 FHA Loans (Federal Housing Administration)

FHA loans are a go-to option for first-time buyers. You can qualify with a lower credit score and put down as little as 3.5%. These loans are backed by the government and designed to help folks just getting into the market.

Why it’s great:

-

Low down payment

-

Easier credit requirements

-

Popular with younger buyers and those with student loan debt

2. VA Loans (For U.S. Veterans & Active Duty Military)

If you’ve served in the military, thank you—and here’s some good news: you may qualify for a VA loan, which means no down payment and no mortgage insurance.

Bonus: Competitive interest rates and flexible credit standards.

3. 🧱 Georgia Dream Homeownership Program

Georgia offers a special program for first-time buyers who meet income and purchase price limits. The Georgia Dream Program can provide down payment assistance—often up to $10,000.

Perfect for:

-

Buyers with steady income but little savings

-

Households earning under $90,000/year (varies by county)

4. 🔑 Conventional 97 Loan

Fannie Mae and Freddie Mac offer this low-down-payment loan—just 3% down! It’s designed for buyers with good credit but not a ton of cash saved up.

Pro tip: Pair it with down payment assistance for even more affordability.

5. 💸 Down Payment Assistance (DPA) Programs

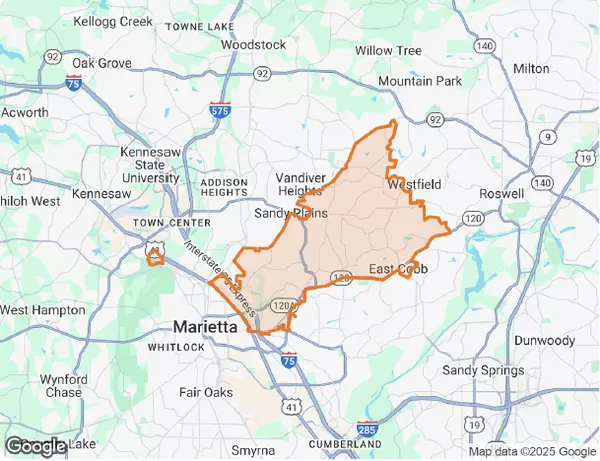

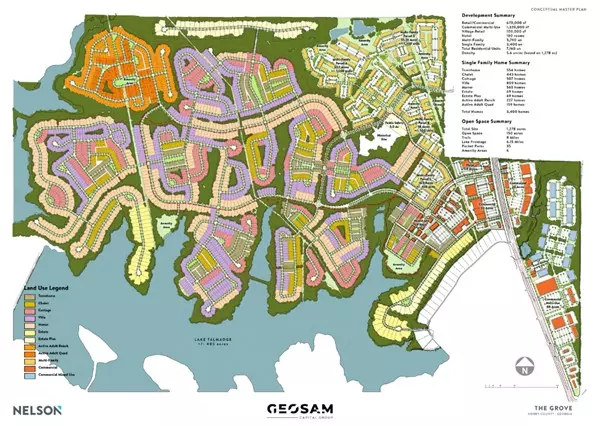

Many cities and counties across Metro Atlanta offer local DPA grants or forgivable loans. These vary by location, but they can be a game-changer if you're buying in places like Roswell, Marietta, or Atlanta proper.

Want help finding one? I’d be happy to point you to programs in your area!

6. 👨👩👧👦 Family Gifts or Co-Signing

Sometimes buyers lean on family to help with a down payment or co-sign a mortgage. If that’s an option, it can help you qualify for a better rate or a bigger loan.

Just be sure to document everything—lenders like paperwork.

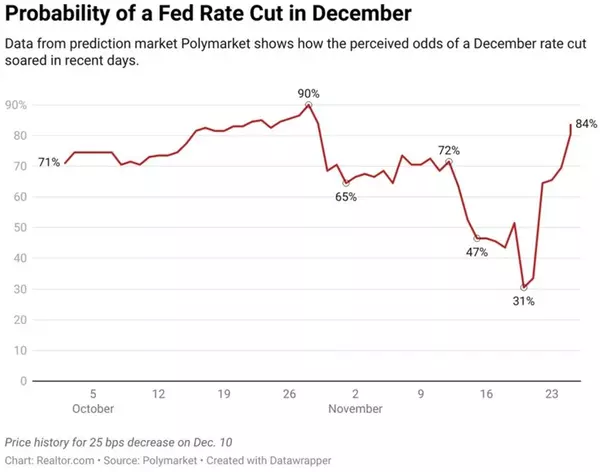

7. 📈 Consider a 2-1 Buydown or Seller Concessions

In this market, many sellers are offering concessions to help buyers lower their interest rates. A 2-1 buydown temporarily reduces your rate for the first two years.

Let’s chat about homes where sellers are open to this—it’s happening more often than you think!

Ready to Take the Next Step?

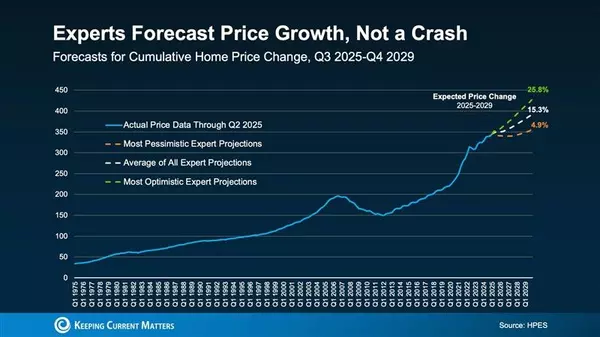

Buying your first home doesn’t have to be stressful—especially if you have the right financing strategy (and a local expert in your corner 😉).

If you’re thinking about making a move in Metro Atlanta, reach out anytime. I’d love to help you explore your options and find the right path to homeownership!

📞 Call or text me at (770) 401-1448

📧 paulmcparlandsr@gmail.com

🌐 paulmcparland.com

Categories

Recent Posts

"Whether buying or selling a home, my #1 job is to advise my clients so they optimize their largest financial investment while avoiding any pitfalls that could cost them tens of thousands of dollars. "