Experts Forecast Steady Home Price Growth in Atlanta Through 2029

In the ever-evolving landscape of the U.S. housing market, recent projections from leading experts paint a picture of sustained, albeit moderated, growth. According to Fannie Mae's Home Price Expectations Survey (HPES), which polls over 100 housing economists and market strategists, national home prices are expected to rise by an average of 15% cumulatively from Q3 2025 through Q4 2029. This forecast signals a return to more stable appreciation rates after the volatile spikes seen during the pandemic era.

For Atlanta residents and potential homebuyers, this national trend aligns with local dynamics, where persistent demand, population growth, and economic vitality are set to drive similar or even slightly stronger price increases. As a real estate professional serving the Atlanta area through paulmcparland.com, I've analyzed these insights to help you navigate what lies ahead.

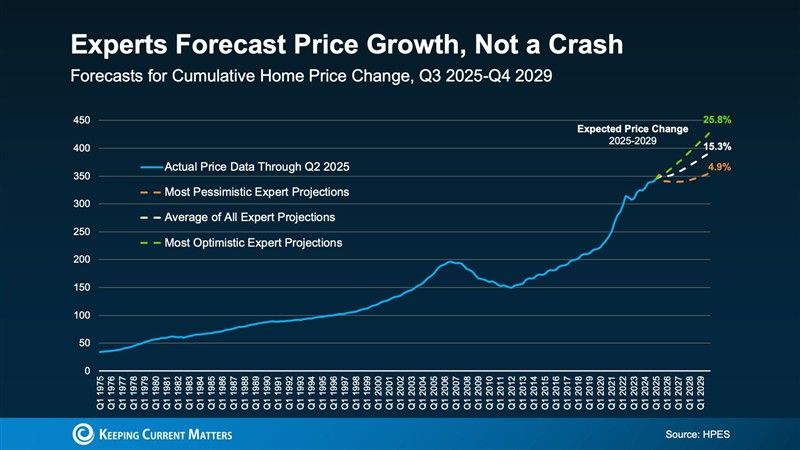

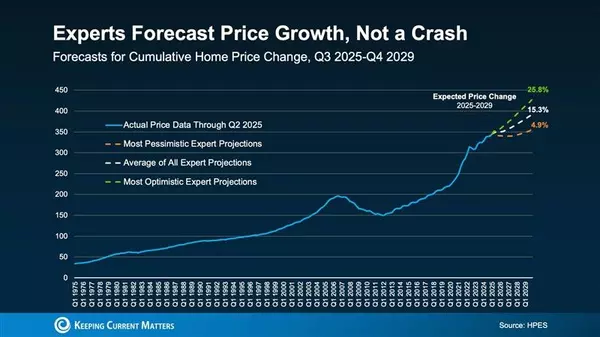

The HPES, sourced from Keeping Current Matters, illustrates this trajectory in a comprehensive chart showing cumulative home price changes since 1975. The actual data line, depicted in blue, traces historical growth through Q2 2025, reflecting the dramatic ups and downs of past decades—including the 2008 crash and the recent pandemic boom. From there, projections branch out: the average of all expert predictions (in black) anticipates a 15.3% rise by 2029, while the most optimistic scenarios (in green) foresee up to 25.8% growth, and even the most pessimistic (in orange) project a modest 4.9% increase. This consensus underscores a key message: home prices are poised for growth, not a crash, with annual appreciation stabilizing around 2-3.5%—below the 25-year historical norm of 4-5%.

Nationally, this moderation comes after years of extraordinary gains. During the height of the COVID-19 pandemic, home prices surged 15-20% annually in many markets, fueled by low interest rates, remote work trends, and a rush to suburban living. Now, as the economy normalizes, experts point to structural factors preventing a downturn. Chief among them is a persistent housing shortage: the U.S. faces a deficit of millions of homes, exacerbated by underbuilding in the post-2008 recovery period. Strong demand from millennials entering their prime homebuying years, coupled with immigration and job growth, further bolsters prices. Affordability remains a challenge, with high mortgage rates and elevated prices squeezing budgets, but analysts argue this won't trigger a 2008-style collapse. Unlike the subprime mortgage crisis, today's borrowers are better qualified, with stronger credit profiles and more equity in their homes.

Shifting focus to Atlanta, the local market mirrors these national trends but with unique advantages that could amplify growth. Atlanta has long been a magnet for opportunity, drawing in tech companies, film productions, and Fortune 500 headquarters like Delta Air Lines and The Home Depot. This economic engine has spurred population growth: the metro area added over 60,000 residents in 2024 alone, according to U.S. Census data, with projections for continued influx through 2029 driven by affordable living costs compared to coastal cities. In terms of home prices, local forecasts suggest Atlanta could outpace the national average slightly, with annual appreciation in the 3-4% range for 2025-2026, potentially leading to a cumulative increase of 15-20% by 2029.

Data from sources like NORADA Real Estate Investments and Zillow support this outlook. As of October 2025, Atlanta's median home value stands at approximately $392,310, down 4.8% from the previous year due to temporary inventory increases and rate fluctuations. However, experts predict a rebound: NORADA forecasts a 3% rise in median home prices for 2025 and 4% in 2026, with new home sales growing 10% and 5%, respectively. Similarly, local real estate analyses from firms like Harry Norman Realtors anticipate 2-3% annual growth in 2025, escalating to 4-6% in hotter neighborhoods like Decatur and Kirkwood, where demand for walkable, urban-suburban blends is high. By 2029, this could translate to median prices approaching $500,000, assuming steady economic conditions.

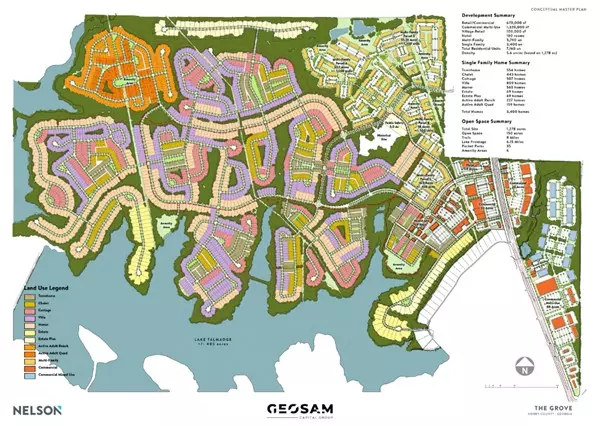

What drives this optimism for Atlanta? First, the housing shortage here is acute. The Atlanta Regional Commission estimates a need for 500,000 additional housing units by 2050 to accommodate growth, but current construction lags behind. In 2025, while multifamily developments are booming—with over 10,000 new apartment units expected, per RealPage—single-family inventory remains tight at around 3-4 months' supply. This scarcity supports price stability. Second, job growth in sectors like technology (with hubs in Midtown and Alpharetta) and logistics (thanks to Hartsfield-Jackson Airport) is projected to add 2-3% annually to employment rolls through 2029, according to the Bureau of Labor Statistics. This influx of high-income professionals sustains demand, particularly in suburbs like Marietta and Roswell, where family-friendly amenities attract buyers.

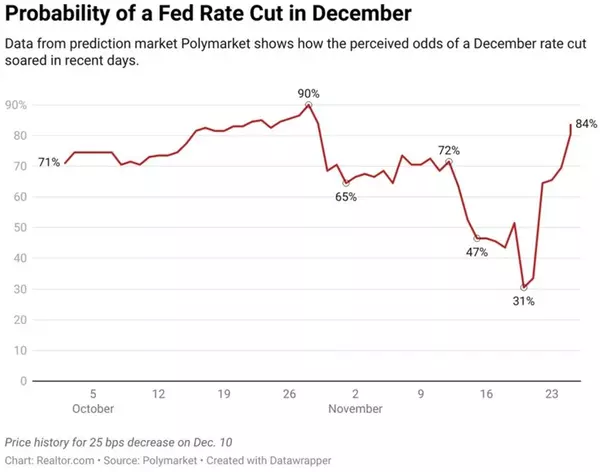

Mortgage rates play a pivotal role too. As of late 2025, 30-year fixed rates hover around 6.5-7%, but forecasts from Fannie Mae and J.P. Morgan suggest a gradual decline to 5.5-6% by 2028-2029, assuming Federal Reserve policies tame inflation. In Atlanta, this could unlock pent-up demand, with sales volumes rising 9-13.5% in 2025 alone, as per local market reports from Cathy LaMon and Sage & Grace Real Estate. For buyers, this means more opportunities but also competition in desirable areas. Sellers, meanwhile, can expect steady equity gains without the fear of a market plunge.

Of course, risks exist. Affordability pressures are real: Atlanta's price-to-income ratio has climbed, making it tougher for first-time buyers. Climate concerns, such as increased flooding in low-lying areas, could impact certain neighborhoods. And while no crash is forecasted, a recession or unexpected rate hikes could temper growth. Yet, experts emphasize resilience. The HPES panel highlights that even pessimistic scenarios show positive appreciation, thanks to underlying supply-demand imbalances. In Atlanta, this is amplified by the city's role as a Sun Belt powerhouse, where migration from higher-cost regions like New York and California continues unabated.

For prospective buyers in Atlanta, now may be an opportune time to act. With inventory improving slightly in 2025—expected to reach 4 months' supply—options are broader than in recent years. Focus on emerging areas like East Atlanta or Grant Park, where values could appreciate 5-7% annually through 2029 due to revitalization projects. Pre-approval for mortgages is crucial, and working with a local expert can uncover off-market deals. Investors should eye rental properties, as single-family rentals are projected to see 2-3% rent growth, outpacing multifamily due to oversupply in apartments.

Sellers, take heart: the market favors you with low foreclosure rates and strong buyer interest. Pricing strategically based on comps from platforms like Zillow or Redfin can maximize returns. Staging and minor updates, especially in kitchens and outdoor spaces, yield high ROI in Atlanta's competitive scene.

Looking ahead, the trajectory for Atlanta's housing market through 2029 is one of balanced progress. National forecasts like those in the HPES provide a roadmap, but local nuances—robust economy, demographic shifts, and infrastructure investments like the BeltLine expansion—position Atlanta for outperformance. Whether you're buying, selling, or investing, understanding these trends empowers informed decisions.

As we approach the end of 2025, remember that real estate is local. At paulmcparland.com, I'm committed to providing tailored guidance for Atlanta's dynamic market. Contact me today to discuss how these forecasts impact your goals.

Categories

Recent Posts

"Whether buying or selling a home, my #1 job is to advise my clients so they optimize their largest financial investment while avoiding any pitfalls that could cost them tens of thousands of dollars. "