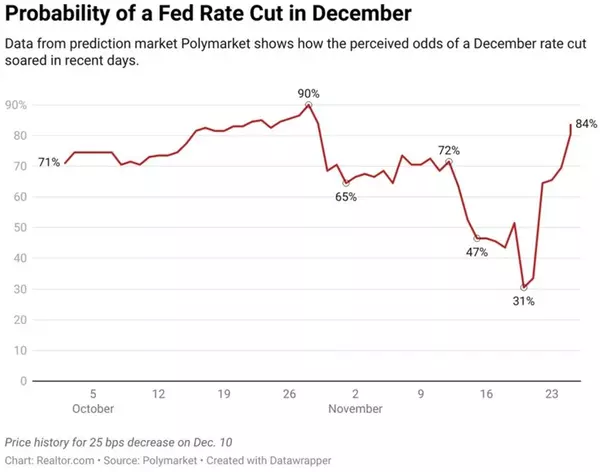

Financing Ideas for First-Time Homebuyers in Atlanta

By Paul McParland, Your Friendly Atlanta Realtor Buying your first home is an exciting milestone—but figuring out how to pay for it? That can feel a little overwhelming. If you’re a first-time homebuyer here in Metro Atlanta (or thinking about becoming one), I’ve put together some helpful financing

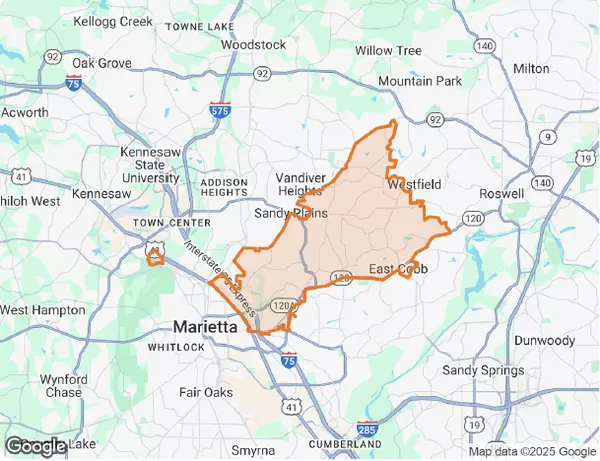

Metro Atlanta Real Estate Market Analysis: May 2025 Update

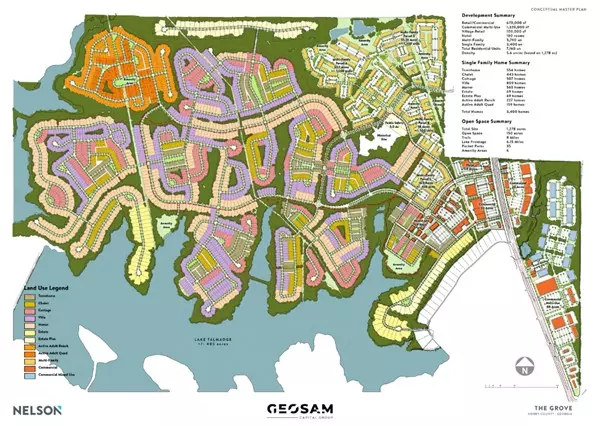

The Metro Atlanta real estate market in May 2025 shows a dynamic landscape for buyers, sellers, and investors. With data from the First Multiple Listing Service (FMLS), we’ll dive into key metrics like new listings, homes for sale, average sold prices, and more, while analyzing trends in the average

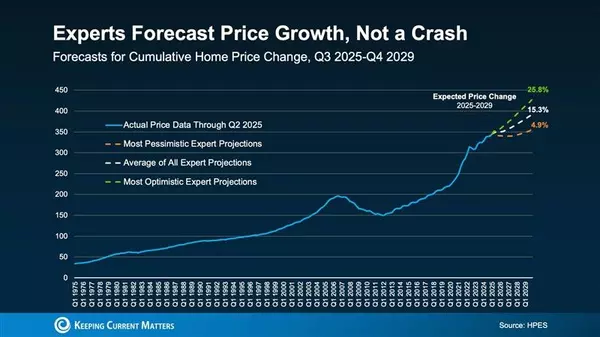

Top 5 Reasons to Buy a Home in Roswell, GA, Now

Thinking about making a move to the northern suburbs of Atlanta? Roswell, GA might just be the perfect place to call home. As a local real estate expert with over 25 years of experience helping families and individuals navigate the Atlanta market, I can say with confidence, Roswell is one of Metro A

Categories

Recent Posts